After investigating multiple solutions, we were impressed with the flexibility and knowledge of the Sparkrock team. Sparkrock’s Finance solution met all our critical component requirements while providing the opportunity for future growth. Their knowledge of our industry and willingness to find solutions to our unique reporting needs made them the best choice for now and the future.

Great Plains (Dynamics GP) End-of-Life: Your Nonprofit Roadmap to the Cloud

Microsoft Great Plains will reach end-of-life in 2029. Now is the time to plan a low-risk migration to the Microsoft cloud ERP that was built for nonprofits and K-12 education.

Turning Great Plains End-of-Life into a Growth Opportunity

Microsoft has officially announced the end-of-life of Dynamics Great Plains, with product support and feature updates winding down by 2029.

That may sound far off — but major system transitions take time to plan, budget, and execute effectively.

Now is the time to plan ahead, assess your systems, and explore a future-ready ERP that will keep your organization secure, compliant, and efficient for years to come.

The Hidden Costs of Staying on Great Plains Too Long

Continuing to rely on Great Plains after support ends introduces growing risks for nonprofits and K–12 organizations:

By planning your migration early, your organization can avoid the last-minute scramble and move forward with confidence.

A Best-In-Class ERP Solution

$3.2

Billion/year

Nonprofit finances managed

$1.1

Billion/year

Nonprofit payroll processed

36k

Employees/month

Nonprofit paystubs processed

20+

Years

Of nonprofit sector experience

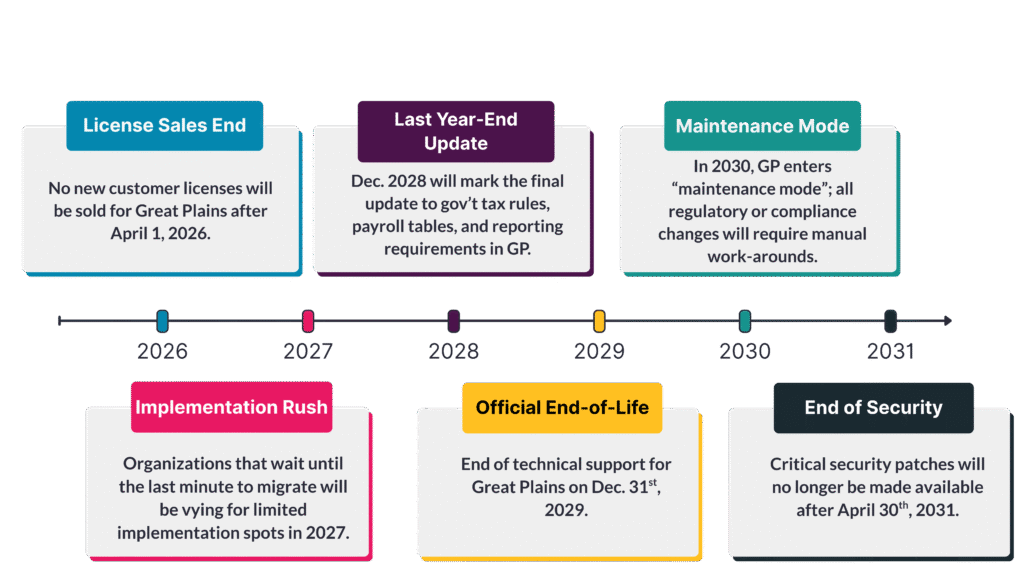

What “End-of-Life” Means for Great Plains Users

When Great Plains reaches end-of-life in 2029, it doesn’t mean your system suddenly stops working—but it does mark the beginning of the end. As of December 31, 2029, Microsoft will no longer release updates, fixes, or regulatory changes that keep the software secure and compliant.

Without new patches, security risks grow, integrations start to break, and tax or payroll tables fall out of date. Over time, it becomes harder and more expensive to maintain, and your organization is left running on a frozen, unsupported system that can’t evolve with your needs.

Great Plains End-of-Life Timeline

As Microsoft winds down support, every year of delay increases risk and cost.

The nonprofits that start planning now will avoid the 2027 implementation bottleneck — and gain the advantage of a modern, cloud-based ERP built for their sector.

Watch: Great Plains End-of-Life Timeline (2 minutes)

The Benefits of a Cloud ERP

Here’s what your peers are gaining by migrating from Microsoft Great Plains to Sparkrock—a Microsoft-based cloud ERP for nonprofits.

Security and Compliance

Stay protected with Microsoft’s trusted cloud security, built-in privacy controls, and compliance standards for nonprofits across the U.S. and Canada.

Automation and Close Speed

Cut days off every close cycle with automated approvals, allocations, and reporting.

Grant and Program Reporting

Manage restricted funds, budgets, and program outcomes in one system.

Anytime, Anywhere Access

Help remote and distributed teams get more done with secure browser-based and mobile ERP access.

Spark Confidence in Your Next Chapter

Avoid the rush and move forward confidently with Sparkrock guiding your transition.

Avoid the last-minute scramble and discover how Sparkrock makes your transition smooth, secure, and built for the future.

Your Great Plains End-of-Life Options

With Great Plains’ EOL date approaching, nonprofits and K-12 organizations in the Microsoft ecosystem have three options in 2026.

Stay Temporarily

Since Great Plains will continue to be updated until 2029, organizations can choose to use GP in 2026 and beyond. They can also defer their migration decision until 2027 or later—however, the rush to secure implementation partners has already begun, and vendor availability (particularly for specialized sectors like nonprofits) will be even more limited in 2027 and 2028.

Migrate to Business Central

Microsoft Dynamics 365 Business Central is a solid option for not-for-profit organizations that are currently using Great Plains. It offers the familiarity of the Microsoft ecosystem, integration with other Microsoft applications, and modern cloud ERP functionality. Many nonprofit-specific capabilities will need to be added on via third-party integrations, which can drive up cost and complexity quickly.

Choose a Specialized ERP

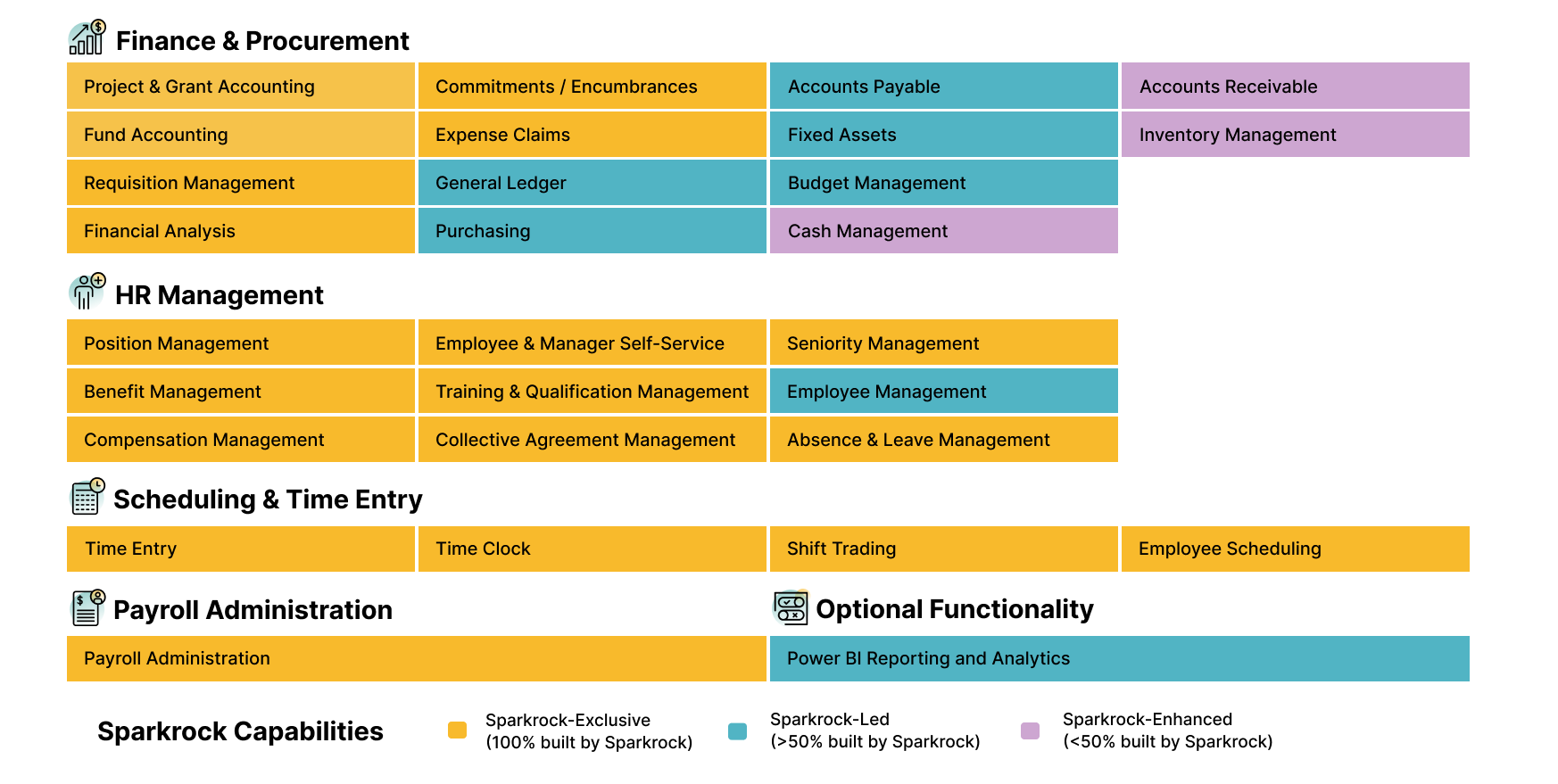

Organizations that want to stay in the robust Microsoft ecosystem but require nonprofit-specific functionality can choose Sparkrock, the cloud ERP that extends Business Central with features like fund accounting, commitments and encumbrances, fixed asset management, expense claims, collective agreement management, and more. Sparkrock offers all of the benefits of Microsoft’s cloud ERP—robust security, advanced Copilot AI, and future-readiness—plus the specific functionality that nonprofit, public sector, and K-12 organizations need to operate with total confidence and clarity.

Nonprofit-Specific Features, Exclusive to Sparkrock

Sparkrock Finance and Sparkrock Impact HRP are built on the robust foundation of Microsoft Dynamics 365 Business Central. Our users enjoy the same security, longevity, and innovation that Microsoft customers expect from their products—plus the exclusive, nonprofit-specific features built in to the system by Sparkrock.

Talk through your options with a nonprofit ERP migration expert.

Your Great Plains Migration Plan

Here’s what to expect if you adopt Sparkrock’s purpose-built ERP for nonprofits.

Design and Configuration

Redesign and streamline your Chart of Accounts and identify relevant dimensions (categories for reporting such as grants, projects, or programs). These sessions ensure your new finance system aligns precisely with your nonprofit’s reporting needs and operations. During configuration, we will map existing data structures to the redesigned chart of accounts and dimensions.

Data Migration and Testing

Data from Great Plains (and/or other previous systems) is extracted, cleansed, standardized, and brought over to the new finance system for initial testing. Historical transaction integrity should be thoroughly validated in this phase, ensuring accuracy and confidence in reporting from day one.

User Training and Testing

Key User Training is conducted for critical staff members responsible for core financial processes, including requisitions, budgeting, expense approvals, and reporting. User Acceptance Testing is essential here—this allows your team to practice realistic workflows, confirming the system’s readiness to handle your organization’s unique procedures.

Go-Live and Support

When your system goes live, expect a period called “hypercare” typically comprising four weeks of elevated support availability. During this time, you’ll get help with closely monitoring system usage, quickly addressing any issues that arise, and finalizing the first month-end cycle. Proactive support during this period helps smooth the transition and stabilizes operations quickly.

Your Roadmap to Modernizing Nonprofit Operations

Are you ready to elevate your nonprofit’s operations with confidence? Our Nonprofit Finance Executive’s Guide to ERP provides essential insights and actionable strategies for assessing, selecting, and successfully implementing an ERP system.

This comprehensive guide walks you through the process of modernizing your organization’s financial operations, offering best practices to help you navigate the complexities of nonprofit-specific needs like fund accounting and grant management. Whether you’re just starting your ERP journey or looking to optimize your current system, this guide equips you with the tools you need to make informed decisions.

Your Collaborative Partner for Nonprofit Modernization

Do you advise nonprofits or K-12 clients still on Great Plains?

We partner with technology consultants, CPAs, and Microsoft resellers to help their clients transition smoothly.

Recommended Resources for Your GP-to-Cloud Journey

Why Great Plains Customers Can’t Wait Until 2029

Discover why 2026 is the tipping point for Microsoft GP users, how looming deadlines and partner backlogs raise risk, and what a smart, low-stress migration plan should include.

Microsoft GP’s Sunset and What It Means for Nonprofit Expense Management

Learn what GP’s end-of-life means for nonprofit expense management, why acting before 2027 matters, and how integrated cloud tools give CFOs clearer, faster numbers.

How Nonprofits Can Build a Confident, Clear ERP Evaluation Process

Learn how to structure your ERP search, align internal teams, and compare vendors effectively so you can choose a system that genuinely fits your nonprofit’s needs.

Your Great Plains Migration Questions, Answered

As Microsoft winds down support for Dynamics GP, this FAQ walks through what the deadlines mean, how to safeguard your data, and why many mission-driven organizations are choosing Sparkrock as their next ERP.

Microsoft officially announced in September 2024 that Dynamics GP will reach the end of mainstream and extended support on December 31, 2029, with security patches continuing until April 30, 2031. This timeline was slightly extended in early 2025 to cover one final year-end update cycle.

While Microsoft has occasionally provided short extensions in the past (for year-end tax updates or technical fixes), it has made it clear that GP’s long-term future lies in Business Central and other cloud solutions. The 2029 / 2031 dates are now firmly aligned with Microsoft’s broader move away from on-premise ERP systems. Another extension is highly unlikely, and organizations should plan migration efforts with the current deadlines in mind.

“End-of-life” doesn’t mean your Great Plains system will suddenly stop running. It means Microsoft will no longer release updates, tax or regulatory changes, or non-security fixes after 2029. You’ll still be able to log in, enter transactions, and run reports, but the system will become increasingly vulnerable over time. Third-party integrations that you may rely on will start to break as they update independently and become incompatible with a legacy ERP.

Without vendor support, routine tasks like updating Windows could cause significant GP downtime. Payroll, fund accounting, and reporting tools may drift out of compliance with CRA or IRS rules, meaning that critical figures like CPP/EI contributions could be miscalculated. By 2030, GP effectively becomes a “frozen” application, leaving IT teams to manage security, maintenance, and compliance risks on their own.

Critically, once Microsoft stops releasing security patches in early 2030, any data still in Great Plains will be extremely vulnerable to threat actors, putting your financial information at significant risk.

No — your data will still be yours. However, once Great Plains reaches end-of-life, how you access and use that data becomes more complex. Legacy systems will no longer receive database or integration updates, and newer reporting tools may not connect properly.

When migrating, Sparkrock helps you:

- Migrate key master data and active balances directly into Sparkrock ERP,

- Archive historical transactions in a secure, searchable data lake or Power BI workspace, and

- Maintain complete audit and reporting trails.

This ensures you retain visibility into every transaction and can respond to audits or board requests even after decommissioning GP.

Most nonprofits and K-12 organizations complete their migration in four to six months, depending on data volume, module complexity, and internal capacity.

The project typically includes a readiness assessment (2–4 weeks), data migration and configuration (2–3 months), training and testing (1–2 months), and a go-live phase aligned to your fiscal year. Organizations with multi-entity consolidations or custom integrations may require additional time, but careful planning helps minimize downtime and ensures continuity during critical grant or payroll periods.

Yes, and in most cases, they improve. Sparkrock is designed to replicate and modernize the key financial structures nonprofits rely on: funds, grants, cost centers, and encumbrances. During migration, our team maps your chart of accounts and reporting dimensions from GP into Sparkrock Finance.

We also leverage Microsoft Power BI to rebuild and enhance your existing reports with real-time dashboards, automated drill-downs, and configurable board-report templates. You’ll retain historical continuity while gaining faster and more flexible insights.

If your organization wants to migrate before GP starts to pose a risk to data security and operational integrity, the best time to start is within your next budgeting cycle. Most nonprofits plan major system investments at least 12–18 months in advance, meaning your 2026 or 2027 budget is the last realistic opportunity to allocate funds for implementation before the partner backlog begins.

Starting early also gives your team time for training, data cleanup, and process mapping, avoiding the last-minute rush that many organizations faced during previous ERP sunsets.

Successful migrations require collaboration across several departments. Typically:

- Finance and Accounting lead requirements-gathering and testing.

- IT manages integrations, data export, and security.

- HR or Payroll teams ensure workforce data transitions correctly.

- Leadership or Board approves the budget and oversees risk mitigation.

Sparkrock supports this cross-functional process with guided workshops and nonprofit-specific project templates, ensuring everyone understands their role and deliverables.

Costs vary depending on organization size, number of users, and integration complexity. Some lower-cost ERP options for nonprofits come with significant functionality gaps, so any initial savings are soon wiped out by add-on costs.

In general, nonprofits can expect the total cost of ownership for a modern, purpose-built cloud ERP to be lower than maintaining Great Plains or a more “general” cloud ERP — eliminating additional costs like servers, backups, manual reporting, and separate integrations.

If you’d like to find out what your exact ERP costs will be, book a Sparkrock demo and we’ll ask you the right questions in order to customize pricing for your organization.

Unlike ERP systems built for profit-driven businesses, Sparkrock is purpose-built for mission-driven organizations. It includes fund accounting, grant tracking, encumbrances, and integrated HR and payroll, all within Microsoft’s secure cloud environment.

Because Sparkrock is built on the Dynamics 365 Business Central platform, it delivers the same reliability and innovation of Microsoft’s ecosystem while layering on nonprofit-specific functionality that other systems lack. As a result, our customers benefit from faster audits, cleaner reporting, and less time spent reconciling systems.

The first step is to book a Sparkrock demo. In this low-stakes session, we’ll ask you a few questions about your organization to help us determine which experts to bring to the table for a Migration Strategy call. During that call, our team reviews your current GP setup, identifies key modules and integrations, and helps you build a phased migration plan aligned with your fiscal year and staffing capacity.

From there, we can provide a readiness checklist, sample project timeline, and cost estimate so you can begin budgeting confidently.